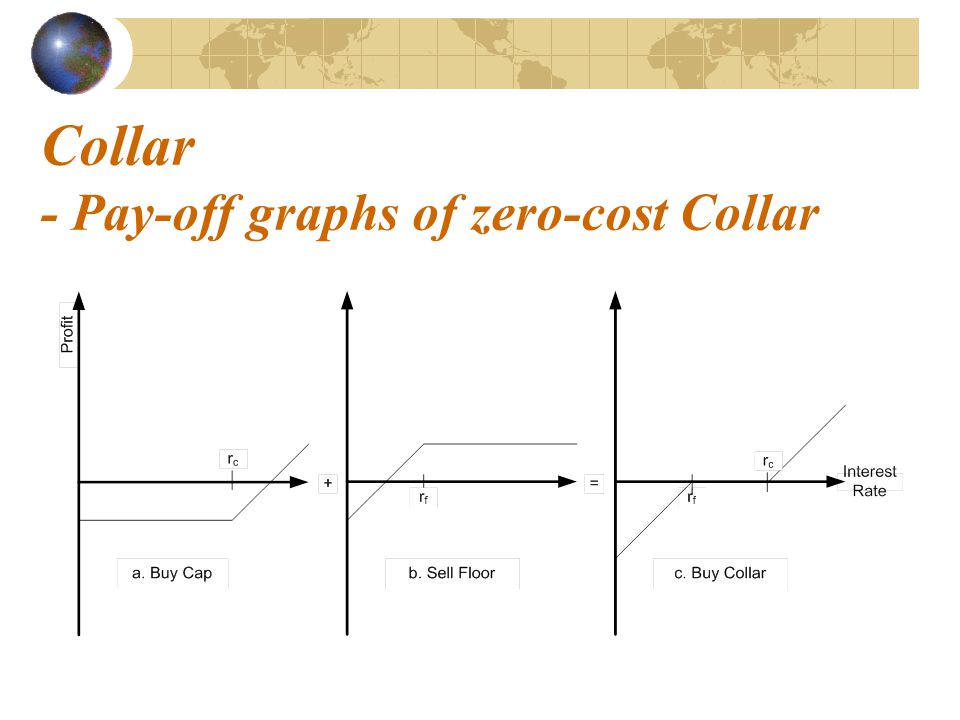

This creates an interest rate range and the collar holder is protected from rates above the cap strike rate but has forgone the benefits of interest rates falling below the floor rate sold.

Interest rate caps floors and collars.

Caps floors and collars 13 interest rate collars a collar is a long position in a cap and a short position in a floor.

Interest rate swap in hedging variable rate debt with a swap an organization agrees to pay out a fixed amount each month to a counterparty in exchange for receipt of a variable rate.

The issuer of a floating rate note might use this to cap the upside of his debt service and pay for the cap with a floor.

The premium for an interest rate collar also depends on the rollover frequency and how you make your premium payments.

An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

For pen drive classes contact no.

For example as a borrower with current market rates at 6 you would pay more for an interest rate collar with a 4 floor and a 7 cap than a collar with a 5 floor and a 8 5 cap.

A barrower may want to limit the interest rate to avoid any rises in the future and buys a cap.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

Interest rate floors are utilized in derivative.

Caps floors and collars are option based interest rate risk management products that put limits to the interest rates.

The interest rate collar involves the simultaneous purchase of an interest rate cap and sale of an interest rate floor on the same index for the same maturity and notional principal amount.

An interest rate collar can be created by buying a cap and selling a floor.

They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably.

:max_bytes(150000):strip_icc()/strategy-4086857_19201-23485cf7c4bf4dbbb95c93f267285f16.jpg)